Oregon Property Tax Limits . For any single property, total school district taxes cannot be more. Just as oregon limits the value to which tax rates apply, the state also limits tax rates. Passed in 1990, measure 5 sets limits on the amount of tax levied per $1,000 of a property’s real market value (rmv): This publication describes oregon’s property tax system through the presentation of statistical information. Chapter 310, property tax rates and amounts; $5 per $1,000 of rmv. Specifically, it presents assessed values, market values, and. Oregon revised statutes title 29, revenue and taxation; What do we mean by “property”? Measure 5 constitutionally limits total nonschool property taxes to one percent ($10 per $1,000 real market value), which significantly limits local revenue options. Floating homes and some manufactured structures are considered taxable personal.

from www.slideserve.com

This publication describes oregon’s property tax system through the presentation of statistical information. Floating homes and some manufactured structures are considered taxable personal. $5 per $1,000 of rmv. For any single property, total school district taxes cannot be more. Just as oregon limits the value to which tax rates apply, the state also limits tax rates. What do we mean by “property”? Specifically, it presents assessed values, market values, and. Oregon revised statutes title 29, revenue and taxation; Measure 5 constitutionally limits total nonschool property taxes to one percent ($10 per $1,000 real market value), which significantly limits local revenue options. Passed in 1990, measure 5 sets limits on the amount of tax levied per $1,000 of a property’s real market value (rmv):

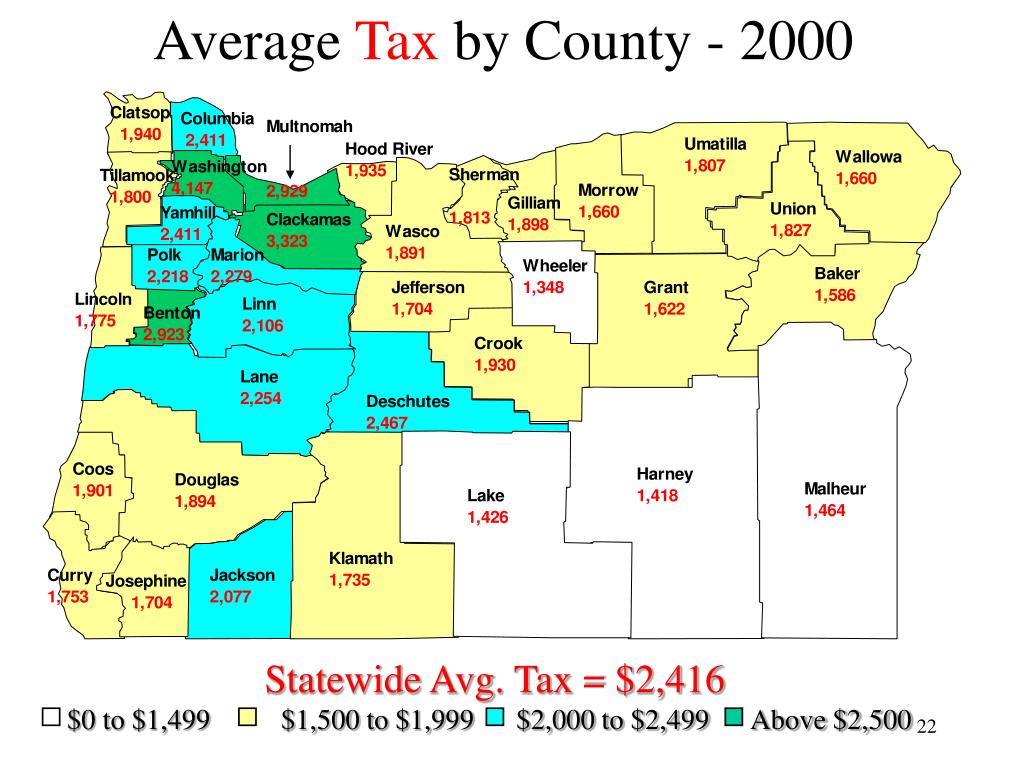

PPT OREGON TAXES PowerPoint Presentation, free download ID69643

Oregon Property Tax Limits Specifically, it presents assessed values, market values, and. Oregon revised statutes title 29, revenue and taxation; Just as oregon limits the value to which tax rates apply, the state also limits tax rates. What do we mean by “property”? $5 per $1,000 of rmv. This publication describes oregon’s property tax system through the presentation of statistical information. For any single property, total school district taxes cannot be more. Chapter 310, property tax rates and amounts; Measure 5 constitutionally limits total nonschool property taxes to one percent ($10 per $1,000 real market value), which significantly limits local revenue options. Specifically, it presents assessed values, market values, and. Floating homes and some manufactured structures are considered taxable personal. Passed in 1990, measure 5 sets limits on the amount of tax levied per $1,000 of a property’s real market value (rmv):

From oregoncatalyst.com

SJR2 busts Measure 50 property tax limits The Oregon Catalyst Oregon Property Tax Limits Chapter 310, property tax rates and amounts; Specifically, it presents assessed values, market values, and. Floating homes and some manufactured structures are considered taxable personal. $5 per $1,000 of rmv. For any single property, total school district taxes cannot be more. Passed in 1990, measure 5 sets limits on the amount of tax levied per $1,000 of a property’s real. Oregon Property Tax Limits.

From propertywalls.blogspot.com

Oregon Property Tax Rate By County Property Walls Oregon Property Tax Limits Chapter 310, property tax rates and amounts; Passed in 1990, measure 5 sets limits on the amount of tax levied per $1,000 of a property’s real market value (rmv): What do we mean by “property”? Floating homes and some manufactured structures are considered taxable personal. Specifically, it presents assessed values, market values, and. $5 per $1,000 of rmv. Measure 5. Oregon Property Tax Limits.

From centraloregonbuzz.com

Oregon Property Taxes Explained Central Oregon Buzz Oregon Property Tax Limits $5 per $1,000 of rmv. Oregon revised statutes title 29, revenue and taxation; Specifically, it presents assessed values, market values, and. This publication describes oregon’s property tax system through the presentation of statistical information. For any single property, total school district taxes cannot be more. Just as oregon limits the value to which tax rates apply, the state also limits. Oregon Property Tax Limits.

From enjus.carto.com

Oregon Counties by homeowners' effective property taxes Oregon Property Tax Limits For any single property, total school district taxes cannot be more. Specifically, it presents assessed values, market values, and. Measure 5 constitutionally limits total nonschool property taxes to one percent ($10 per $1,000 real market value), which significantly limits local revenue options. $5 per $1,000 of rmv. This publication describes oregon’s property tax system through the presentation of statistical information.. Oregon Property Tax Limits.

From www.oregonlive.com

Property tax rates in Oregon's 36 counties, ranked Oregon Property Tax Limits What do we mean by “property”? Passed in 1990, measure 5 sets limits on the amount of tax levied per $1,000 of a property’s real market value (rmv): Chapter 310, property tax rates and amounts; This publication describes oregon’s property tax system through the presentation of statistical information. Floating homes and some manufactured structures are considered taxable personal. $5 per. Oregon Property Tax Limits.

From www.oregonlive.com

Property tax rates in Oregon's 36 counties, ranked Oregon Property Tax Limits Floating homes and some manufactured structures are considered taxable personal. What do we mean by “property”? Just as oregon limits the value to which tax rates apply, the state also limits tax rates. Passed in 1990, measure 5 sets limits on the amount of tax levied per $1,000 of a property’s real market value (rmv): Specifically, it presents assessed values,. Oregon Property Tax Limits.

From www.oregonlive.com

Confused by your Oregon property tax bill? Ask the Property Tax Fairy Oregon Property Tax Limits Chapter 310, property tax rates and amounts; This publication describes oregon’s property tax system through the presentation of statistical information. $5 per $1,000 of rmv. Specifically, it presents assessed values, market values, and. Oregon revised statutes title 29, revenue and taxation; What do we mean by “property”? Floating homes and some manufactured structures are considered taxable personal. Passed in 1990,. Oregon Property Tax Limits.

From www.columbiacountyor.gov

Columbia County, Oregon Official Website Understanding your Property Oregon Property Tax Limits Chapter 310, property tax rates and amounts; This publication describes oregon’s property tax system through the presentation of statistical information. $5 per $1,000 of rmv. Just as oregon limits the value to which tax rates apply, the state also limits tax rates. Measure 5 constitutionally limits total nonschool property taxes to one percent ($10 per $1,000 real market value), which. Oregon Property Tax Limits.

From www.templateroller.com

Oregon County Property Tax for Floating Property Download Printable PDF Oregon Property Tax Limits For any single property, total school district taxes cannot be more. $5 per $1,000 of rmv. Floating homes and some manufactured structures are considered taxable personal. Measure 5 constitutionally limits total nonschool property taxes to one percent ($10 per $1,000 real market value), which significantly limits local revenue options. Chapter 310, property tax rates and amounts; Oregon revised statutes title. Oregon Property Tax Limits.

From www.oregonlive.com

How do your property taxes compare to your neighbors'? Multnomah County Oregon Property Tax Limits Specifically, it presents assessed values, market values, and. Measure 5 constitutionally limits total nonschool property taxes to one percent ($10 per $1,000 real market value), which significantly limits local revenue options. Floating homes and some manufactured structures are considered taxable personal. Chapter 310, property tax rates and amounts; Just as oregon limits the value to which tax rates apply, the. Oregon Property Tax Limits.

From oregoncatalyst.com

Portland area property tax bills would increase over 13 The Oregon Oregon Property Tax Limits Floating homes and some manufactured structures are considered taxable personal. Chapter 310, property tax rates and amounts; Oregon revised statutes title 29, revenue and taxation; $5 per $1,000 of rmv. Specifically, it presents assessed values, market values, and. What do we mean by “property”? This publication describes oregon’s property tax system through the presentation of statistical information. Measure 5 constitutionally. Oregon Property Tax Limits.

From oregoncatalyst.com

Lawmakers’ double property tax! The Oregon Catalyst Oregon Property Tax Limits Oregon revised statutes title 29, revenue and taxation; Floating homes and some manufactured structures are considered taxable personal. Measure 5 constitutionally limits total nonschool property taxes to one percent ($10 per $1,000 real market value), which significantly limits local revenue options. Just as oregon limits the value to which tax rates apply, the state also limits tax rates. Passed in. Oregon Property Tax Limits.

From theopt.com

Explaining Oregon Property Taxes Opt Real Estate Oregon Property Tax Limits This publication describes oregon’s property tax system through the presentation of statistical information. Oregon revised statutes title 29, revenue and taxation; Specifically, it presents assessed values, market values, and. Floating homes and some manufactured structures are considered taxable personal. $5 per $1,000 of rmv. Chapter 310, property tax rates and amounts; Passed in 1990, measure 5 sets limits on the. Oregon Property Tax Limits.

From pdxadu.blogspot.com

Building an Accessory Dwelling Unit (ADU) in Portland Oregon Property Oregon Property Tax Limits Measure 5 constitutionally limits total nonschool property taxes to one percent ($10 per $1,000 real market value), which significantly limits local revenue options. $5 per $1,000 of rmv. What do we mean by “property”? Floating homes and some manufactured structures are considered taxable personal. For any single property, total school district taxes cannot be more. Chapter 310, property tax rates. Oregon Property Tax Limits.

From www.oregonlive.com

Oregon's property tax system doesn't need an overhaul Oregon Property Tax Limits Chapter 310, property tax rates and amounts; Passed in 1990, measure 5 sets limits on the amount of tax levied per $1,000 of a property’s real market value (rmv): Oregon revised statutes title 29, revenue and taxation; What do we mean by “property”? Measure 5 constitutionally limits total nonschool property taxes to one percent ($10 per $1,000 real market value),. Oregon Property Tax Limits.

From www.slideserve.com

PPT OREGON TAXES PowerPoint Presentation, free download ID69643 Oregon Property Tax Limits This publication describes oregon’s property tax system through the presentation of statistical information. Measure 5 constitutionally limits total nonschool property taxes to one percent ($10 per $1,000 real market value), which significantly limits local revenue options. For any single property, total school district taxes cannot be more. Passed in 1990, measure 5 sets limits on the amount of tax levied. Oregon Property Tax Limits.

From www.bizjournals.com

Sherman, Harney counties among the Oregon locales with the best Oregon Property Tax Limits Just as oregon limits the value to which tax rates apply, the state also limits tax rates. Passed in 1990, measure 5 sets limits on the amount of tax levied per $1,000 of a property’s real market value (rmv): Floating homes and some manufactured structures are considered taxable personal. $5 per $1,000 of rmv. For any single property, total school. Oregon Property Tax Limits.

From www.youtube.com

Understanding Oregon Property Taxes YouTube Oregon Property Tax Limits Just as oregon limits the value to which tax rates apply, the state also limits tax rates. This publication describes oregon’s property tax system through the presentation of statistical information. Oregon revised statutes title 29, revenue and taxation; For any single property, total school district taxes cannot be more. Specifically, it presents assessed values, market values, and. Floating homes and. Oregon Property Tax Limits.